Why GST Reconciliation Is Crucial for Every Taxpayer in India

By Taxurban Admin on 31 Aug 2024

In the ever-evolving landscape of taxation in India, GST (Goods and Services Tax) stands out as a significant reform that has streamlined the tax system. However, with its complexities come the challenges of ensuring accuracy and compliance. One such challenge is GST reconciliation, a crucial process that every taxpayer must understand and implement. In this blog, we’ll explore why GST reconciliation is essential for every taxpayer, the benefits it offers, and how it can impact your business.

What Is GST Reconciliation?

GST reconciliation is the process of comparing and matching the GST records maintained by a business with those submitted to the GST authorities. It involves reconciling the data in the GST returns filed by a taxpayer with the data available in the GST portal.

The primary objective of GST reconciliation is to ensure that all records are accurate, consistent, and compliant with GST regulations. This process helps in identifying discrepancies and resolving them before they lead to issues such as penalties or legal troubles.

Why GST Reconciliation Is Important

- Avoiding Penalties and Legal Issues

One of the primary reasons for conducting regular GST reconciliation is to avoid penalties and legal issues. The GST laws impose stringent penalties for errors or discrepancies in GST returns. By reconciling your records, you can identify and correct mistakes before they result in penalties.

For example, if a company mistakenly claims excess input tax credit (ITC), it could face significant penalties. Regular reconciliation helps in catching such errors early and making necessary corrections.

- Ensuring Accurate Tax Filing

Accurate tax filing is critical to maintaining compliance with GST regulations. GST reconciliation ensures that the figures reported in your GST returns match those in your financial records and the GST portal. This accuracy is essential for avoiding disputes with tax authorities and ensuring that your tax filings reflect the true financial status of your business.

- Maximizing Input Tax Credit (ITC)

Input Tax Credit (ITC) allows businesses to claim credit for the tax paid on inputs used for providing taxable supplies. Proper GST reconciliation helps in ensuring that you are claiming the correct amount of ITC and that there are no discrepancies between the credits claimed and the credits available in the GST portal.

For instance, if a business incorrectly reports its ITC, it could miss out on potential tax savings. Reconciliation helps in identifying and rectifying such issues, ensuring that you maximize your ITC claims.

- Maintaining Financial Health

Regular GST reconciliation helps in maintaining the financial health of your business by ensuring that your GST records are accurate and up-to-date. Discrepancies in GST records can lead to cash flow issues, financial mismanagement, and problems with financial planning.

For example, if discrepancies lead to unexpected tax liabilities, it could strain your business’s finances. Reconciliation helps in preventing such situations by keeping your records aligned with GST requirements.

- Facilitating Smooth Audits

GST audits are a part of the compliance process, and having reconciled records makes the audit process smoother and more efficient. When your records are accurate and reconciled, you can provide the necessary documentation quickly, reducing the likelihood of complications during an audit.

- Building Trust with Stakeholders

Accurate GST reconciliation not only helps in regulatory compliance but also builds trust with stakeholders, including investors, clients, and partners. Transparent and accurate GST records reflect the credibility and reliability of your business, fostering positive relationships with stakeholders.

For example, a company with well-maintained GST records is likely to build stronger relationships with financial institutions and investors, enhancing its reputation and credibility.

- Streamlining Business Operations

GST reconciliation helps in identifying and addressing operational inefficiencies. By regularly reviewing and reconciling GST records, businesses can streamline their processes, improve accuracy, and enhance overall operational efficiency.

For instance, if reconciliation reveals repeated errors in invoice processing, a business can address these issues to prevent future mistakes and improve its operational processes.

- Enhancing Compliance and Reducing Risk

By staying on top of GST reconciliation, businesses can enhance their overall compliance with GST regulations and reduce the risk of non-compliance. This proactive approach helps in avoiding legal troubles, fines, and disputes with tax authorities.

For example, a proactive approach to reconciliation can help a business identify potential compliance issues early and take corrective actions, reducing the risk of facing penalties or legal challenges.

How to Conduct GST Reconciliation

- Compare GST Returns with Financial Records

- Regularly compare the data reported in your GST returns with your financial records to ensure consistency and accuracy.

- Match GST Invoices and Receipts

- Ensure that all GST invoices and receipts are accurately recorded and match the entries in your GST returns.

- Review ITC Claims

- Regularly review your ITC claims to ensure that they are in line with the credits available in the GST portal.

- Address Discrepancies Promptly

- Identify and address any discrepancies or errors promptly to avoid complications and penalties.

- Seek Professional Assistance

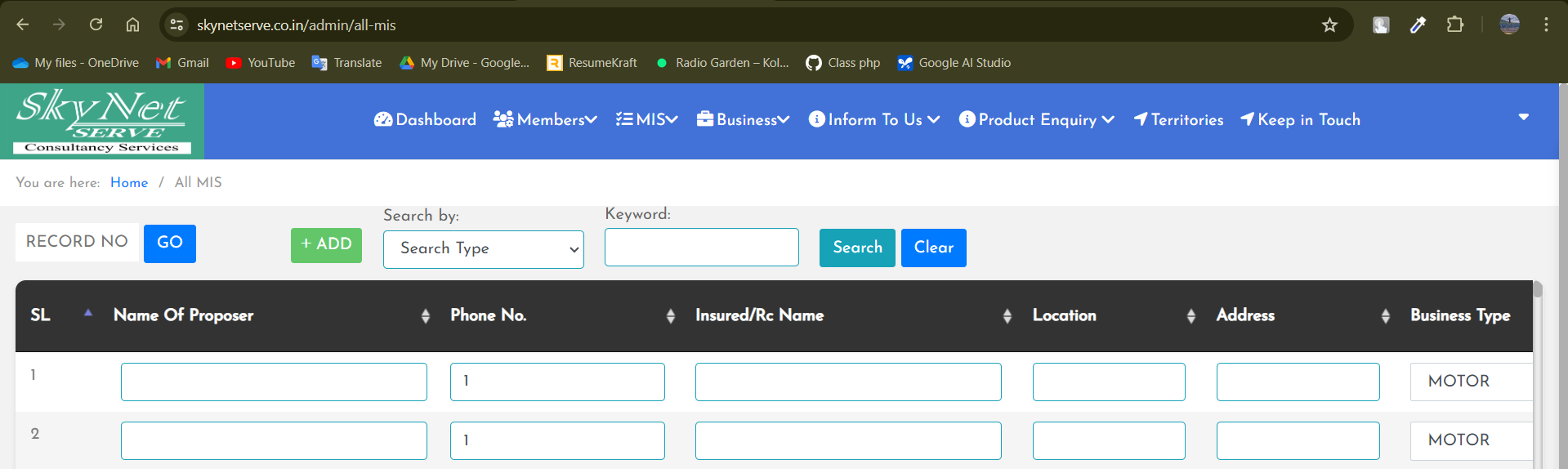

- Consider seeking professional assistance from tax advisors or accountants to ensure accurate and efficient GST reconciliation.

Conclusion: The Key to GST Compliance

GST reconciliation is a crucial process that every taxpayer in India must undertake to ensure compliance with GST regulations. By regularly reconciling your GST records, you can avoid penalties, maximize ITC claims, maintain financial health, and facilitate smooth audits.

At Taxurban, we understand the complexities of GST compliance and are here to assist you in managing your GST reconciliation effectively. Our expert team can guide you through the reconciliation process, ensuring accuracy and compliance.

Need help with GST reconciliation? Contact Taxurban today for expert guidance and support in managing your GST obligations.

Leave A Comment